2024 Tax Filing Start Date Canada – The Canada Revenue Agency (CRA) can charge penalties and interest on any returns or amounts we have not received by the due date personal income tax refund will also be held. If you are closing a . Many lower-income and vulnerable Canadians are missing out on valuable benefit and credit payments because they are not filing their income tax and benefit returns. Benefit and credit payments, such .

2024 Tax Filing Start Date Canada

Source : turbotax.intuit.ca

Tax breaks to know about for 2024 in Canada | CTV News

Source : www.ctvnews.ca

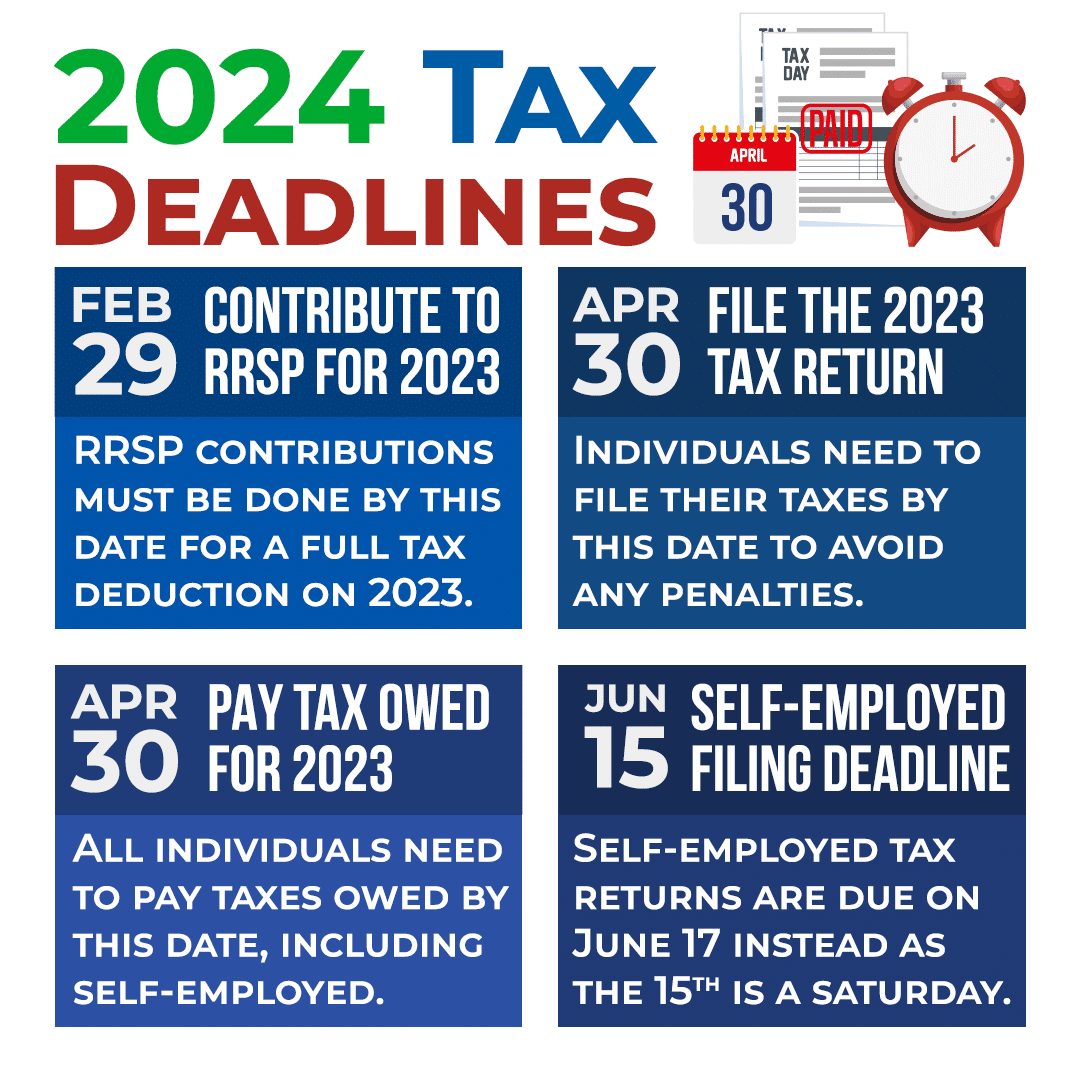

Canada Tax Filing Deadlines 2024 Advanced Tax Services

Source : advancedtax.ca

Kingston Seniors on X: “Tax filing season is coming up soon and do

Source : twitter.com

Tax Season 2023: Who Needs To File A Tax Return? – Forbes Advisor

Source : www.forbes.com

Women Who Freelance Canada | ???? It’s the time of the year! 2024

Source : www.instagram.com

Canada’s Tax Brackets For 2024 Are Out Now & This Is How Your

Source : www.narcity.com

Tax Partners | ???? It’s Tax Time in Canada! Secure your finances

Source : www.instagram.com

Canada’s tax deadlines for 2024 | Advanced Tax Services Inc, CPA

Source : www.linkedin.com

Financial Consumer Agency of Canada (FCAC)

Source : m.facebook.com

2024 Tax Filing Start Date Canada Tax Deadline 2024: When Is the Last Day to File Taxes? | 2023 : An increasing number of Canadians have delayed filing their taxes because they’re worried about owing money this year, according to a new survey by H&R Block Canada. With less than a week to go before . You do not need to file a tax return before you can begin receiving benefits and credits during your first year in Canada. However, you do need to file a tax return to continue getting benefits and .